When you pick up your prescription at the pharmacy, you might not think about why your $10 copay is for a generic pill instead of the brand name you asked for. But behind that simple transaction is a complex system designed to save money - mostly for your employer, and sometimes for you. The key? Generic drugs and how they’re structured in your employer’s health plan.

Why Your Plan Pushes Generics

Your employer doesn’t just prefer generic medications because they’re cheaper - they’re required to. Prescription drug costs are one of the biggest drivers of rising health insurance premiums. In 2023, generic drugs saved the U.S. healthcare system over $150 billion in a single year. That’s $3 billion every week. For employers, that’s not just a nice savings - it’s a necessity. The Food and Drug Administration (FDA) confirms that generic drugs are just as safe and effective as brand-name versions. They contain the same active ingredients, work the same way, and meet the same strict quality standards. The only real difference? Price. Generics cost 80-85% less because they don’t need to pay for expensive clinical trials, advertising, or marketing campaigns. So when your employer’s plan pushes you toward generics, it’s not a cost-cutting trick - it’s a science-backed strategy.How Formularies Work: The Tier System Explained

Every employer health plan uses a formulary - a list of approved medications - organized into tiers. These tiers determine how much you pay out of pocket. Here’s how it typically breaks down:- Tier 1: Generics - Usually $10 or less per prescription. This is where your plan wants you to be.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications that your plan has negotiated lower prices for. Expect a $40 copay.

- Tier 3: Non-Preferred Brand-Name Drugs - If there’s a generic available but you still want the brand, this is where you’ll pay more - often $75 or higher.

- Tier 4: Specialty Drugs - For complex conditions like cancer, MS, or rheumatoid arthritis. These can cost hundreds or even thousands per month.

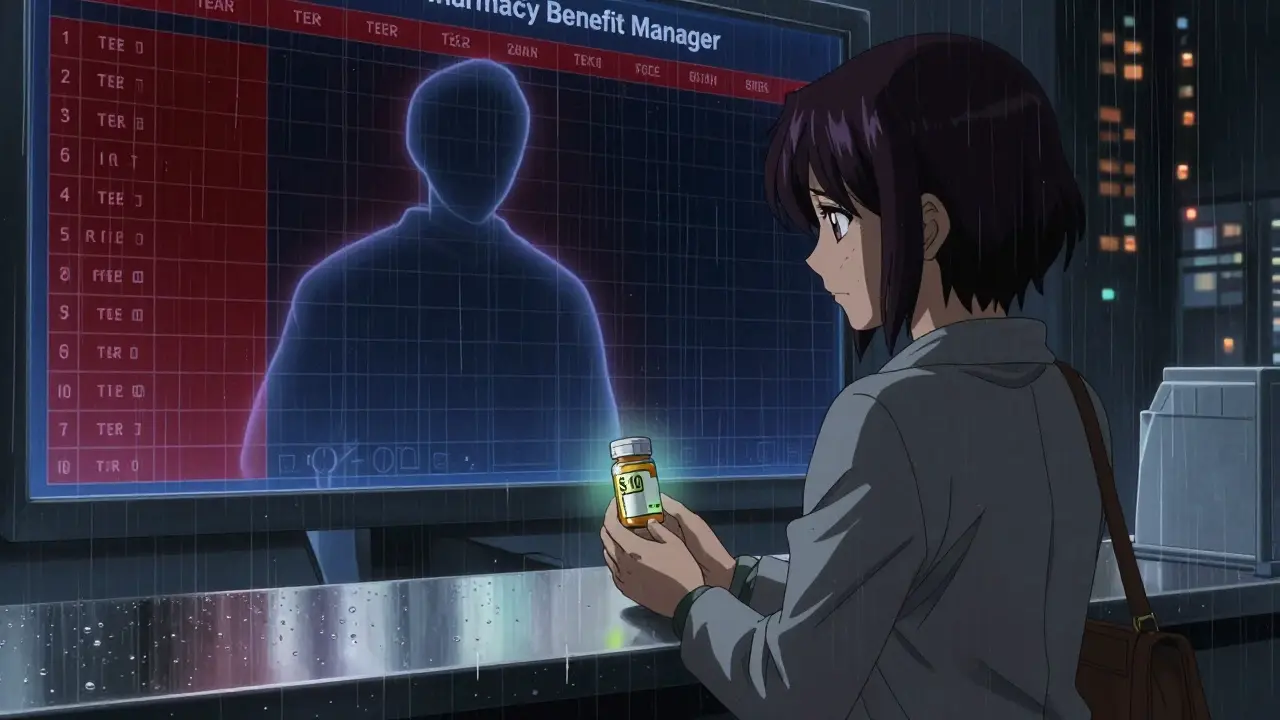

Who Runs the Show? The Power of PBMs

You might not know it, but three companies control most of your prescription coverage: OptumRx, CVS Caremark, and Express Scripts. These Pharmacy Benefit Managers don’t just list drugs - they decide which ones get covered at all. In January 2024, each of them removed more than 600 drugs from their formularies. That’s over 1,800 medications pulled nationwide in a single month. Why? It’s not random. These exclusions are bargaining chips. Drug manufacturers pay PBMs huge rebates to keep their drugs on the formulary. If a company refuses to pay enough, the PBM drops the drug. That puts pressure on the manufacturer to lower prices - or lose access to millions of patients. But here’s the catch: those rebates don’t always reach you. PBMs use a pricing model called gross-to-net (GTN), where the list price of a drug is much higher than what they actually pay. On average, the gap is 55%. That means if a drug’s list price is $100, the PBM might pay only $45 after rebates. The rest? Kept by the PBM or returned to the drugmaker. You, the employee, still pay based on the list price - not the discounted net price. So while your employer saves money, your copay might not drop as much as you’d expect.

What Happens When Your Medication Gets Removed?

Imagine you’ve been taking a brand-name medication for years. One day, your pharmacy tells you it’s no longer covered. That’s not a mistake - it’s a formulary change. These updates happen all the time, often without warning. The Ohio Department of Administrative Services warns that changes can occur “at any time and without advance notice.” If your drug gets dropped, you have options:- Switch to the generic version - if one exists.

- Ask your doctor for a different drug on the formulary.

- File a medical necessity exception with your insurer. This requires your doctor to prove the brand-name drug is essential for your health.

- Pay full price out of pocket - which can be hundreds of dollars per month.

How to Find Out What’s Covered

You can’t rely on memory or past experience. Formularies change constantly. To know exactly what your plan covers:- Visit your insurer’s website and search for your plan’s drug list. Look for “formulary,” “drug list,” or “covered medications.”

- Check your Summary of Benefits and Coverage (SBC). It’s a short document your employer must give you - it includes a sample list of covered drugs.

- Call your insurer directly. Ask: “Is [medication name] covered under my plan? What tier is it on? Is there a generic?”

- Use your pharmacy’s app or website. Many show real-time pricing and coverage before you even fill the prescription.

Why Employers Push CDHPs and Generic Incentives

More employers are turning to Consumer-Driven Health Plans (CDHPs). These plans combine high-deductible health insurance with a health savings account (HSA). The goal? Make you more cost-conscious. To make CDHPs work, employers add extra incentives:- Lower copays for generics - sometimes $5 instead of $10.

- Free shipping for mail-order generics.

- Automatic substitution at the pharmacy - no need to ask.

- Educational campaigns - emails, posters in the break room, payroll stuffers - explaining why generics are safe and smart.

The Real Problem: Savings That Don’t Reach You

The system works great for employers and PBMs. But for you? It’s mixed. You get cheaper generics, sure. But if you need a brand-name drug, you’re stuck paying more - even though the actual cost to the system is much lower thanks to rebates. Scott Glovsky, a healthcare analyst, puts it bluntly: “The savings on pharmaceutical medications may not be passed to you.” That’s the hidden flaw. The $150 billion saved annually isn’t reflected in your paycheck or your copay. It’s absorbed by the system - and often, it’s PBMs keeping the difference. Some employers are starting to push for more transparency. A few are switching to direct contracting models where they pay the net price - not the list price - and pass the savings directly to employees. But these are still rare.What You Can Do Right Now

You can’t control your employer’s plan. But you can control how you use it.- Always ask your pharmacist: “Is there a generic version?”

- Ask your doctor: “Is there a generic alternative?” Don’t assume your prescription is the only option.

- Use mail-order pharmacies for maintenance meds - they often have the lowest prices.

- Sign up for programs like HealthOptions.org’s Price Assure Program - if your employer offers it - which automatically applies discounts on generics.

- If you’re on a chronic condition, ask if your plan has a Chronic Illness Support Program. These often include care managers who help you find affordable alternatives.

Final Thought: Generics Aren’t a Compromise - They’re the Smart Choice

There’s a myth that generics are “second-rate.” They’re not. They’re the same medicine, sold at a fraction of the cost. Your employer pushes them because they’re the best tool we have to make healthcare affordable. And for you? Choosing a generic isn’t settling - it’s saving money, without sacrificing quality. The real challenge isn’t understanding generics. It’s understanding the system behind them. Once you know how formularies work, who controls them, and how to navigate them, you’re no longer passive. You’re in control.Are generic drugs really as good as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict standards for purity, stability, and performance. The only differences are in inactive ingredients (like fillers) and packaging - neither affects how well the drug works.

Why is my generic drug suddenly not covered anymore?

It’s likely not your generic - it’s the brand-name version that’s being removed. When a generic becomes available, PBMs often move the brand-name drug to a higher tier (Tier 3 or 4) or off the formulary entirely. Your generic should still be covered at the lowest copay. If your generic was removed, it’s rare but possible due to supply issues or new formulary rules. Contact your insurer to confirm.

Can I get my brand-name drug covered if the generic doesn’t work for me?

Yes. You can request a medical necessity exception. Your doctor must submit documentation explaining why the generic caused side effects, failed to control your condition, or isn’t suitable for your health needs. Many plans approve these requests - especially for conditions like epilepsy, depression, or autoimmune diseases where small differences in formulation matter.

Why does my copay for the same drug keep changing?

Formularies are updated frequently - sometimes monthly. PBMs renegotiate deals with drugmakers, new generics enter the market, or drugs get removed for cost reasons. Your plan’s drug list changes without notice. Always check your coverage before filling a prescription, especially if you refill monthly.

Do all employer plans use the same formulary tiers?

No. While most use a 3- or 4-tier system, the exact copays and drug lists vary by insurer and employer. Anthem, for example, offers six different drug lists for different employer plans. Your plan’s formulary is unique. Always refer to your specific plan documents - don’t assume your friend’s plan works the same way.

How do I know if my employer’s plan is good for prescriptions?

Look at three things: (1) Are generics on Tier 1 with a $10 or lower copay? (2) Are common brand-name drugs you or your family use still covered at a reasonable cost? (3) Is there a clear process for requesting exceptions? If your plan covers most generics at $10 and allows exceptions for necessary brand-name drugs, it’s likely a strong one.

Dan Alatepe

December 28, 2025 AT 04:35So let me get this straight - my employer saves billions, PBMs pocket the difference, and I’m still paying $10 for a pill that’s technically the same as the $300 one I used to take? 😅 I’m not mad… I’m just disappointed. Like, I get it, generics are fine - but why does it feel like I’m being played by a boardroom full of guys in suits who’ve never even held a pill bottle? 🤷♂️

Angela Spagnolo

December 28, 2025 AT 10:56...i just checked my formulary... and... wow... my asthma inhaler moved to tier 3? i didn't even know they could do that?? i've been on it for 12 years... i'm gonna call my doctor tomorrow... please someone tell me i'm not alone in this??

Sarah Holmes

December 29, 2025 AT 06:49It is not merely a matter of cost-efficiency; it is a systemic betrayal of the patient-provider relationship. The Pharmacy Benefit Managers - these opaque, unregulated corporate entities - have assumed the role of de facto medical decision-makers, wielding rebates like weapons and formularies as instruments of control. The FDA may certify equivalence, but clinical outcomes are not reduced to chemical composition alone. Bioequivalence is not therapeutic equivalence. And to suggest that patients should be grateful for being coerced into cheaper alternatives is not only morally bankrupt - it is medically irresponsible.

Jay Ara

December 29, 2025 AT 14:06bro i used to hate generics till i tried one for my blood pressure and it worked same as the brand... now i just ask for the generic every time... saves me like 70 bucks a month... my mom still thinks they're fake but she's old school lol

Michael Bond

December 31, 2025 AT 10:54Generics work. Ask your doctor. Save money.

Kuldipsinh Rathod

January 1, 2026 AT 11:12my cousin in delhi pays $1 for his generic diabetes med... here in the states we're still paying $10... i think the system is broken... not the generics

SHAKTI BHARDWAJ

January 2, 2026 AT 19:17oh so now we're supposed to be grateful because we're not being charged $400 for a pill?? what a joke. you think i don't know they're making 10x profit on the 'discounted' price?? this is corporate gaslighting wrapped in a FDA sticker. and don't even get me started on how they drop meds without warning... my thyroid med got yanked last month and i had to beg my doctor for an exception... and guess what? they approved it... because i cried. that's how broken this is.

Matthew Ingersoll

January 2, 2026 AT 21:37As someone who lived in India for five years, I can tell you that generic drugs there are often manufactured in the same facilities as brand-name ones - just without the marketing. The FDA’s oversight is actually quite rigorous. The real issue isn’t the quality of generics - it’s the opacity of the PBM system. In many countries, the government negotiates directly with manufacturers. Here, it’s a black box. We need transparency, not just gratitude.

Jody Kennedy

January 3, 2026 AT 09:43STOP. Just stop. I was skeptical too - until my anxiety meds switched and I felt better than ever. No jitters. No brain fog. Just calm. Generics aren’t a compromise - they’re a revolution. And if your doctor says it’s safe, trust them. And if your plan gives you free mail-order? TAKE IT. Your future self will thank you. 💪