Running out of medication because you can’t afford it isn’t just stressful-it’s dangerous. In 2026, nearly one in four Americans still skip doses or delay refills because of cost. The system is stacked: brand-name drugs cost ten times more here than in Canada or the UK, while insurance plans hide fees behind layers of bureaucracy. But you’re not powerless. Coupons, generics, and prior authorizations aren’t just buzzwords-they’re tools you can use to cut your drug bills by hundreds or even thousands a year.

Why Your Prescription Costs So Much (And Why It’s Not What You Think)

The sticker price on your pill bottle? That’s the list price, and it’s mostly fake. Pharmaceutical companies set high list prices so they can offer big discounts to pharmacy benefit managers (PBMs), who then negotiate rebates behind closed doors. You never see those savings. Instead, your copay is often based on that inflated list price-even if the drug only costs $5 to make.

Take insulin. In 2023, the average list price for a vial was $120. But after rebates and discounts, the net price was closer to $40. Yet, many patients still paid $100+ per vial because their insurance used the list price to calculate their copay. That’s not a pricing error-it’s how the system works.

The Inflation Reduction Act (IRA) of 2022 started changing this. Starting January 2026, Medicare negotiated prices for 10 high-cost drugs, slashing what seniors pay. For example, the diabetes drug Lantus dropped from $120 to $25 per vial. That’s a 79% cut. And by 2027, Medicare will cap out-of-pocket drug spending at $2,000 a year-no more coverage gaps, no more surprise bills.

Generic Drugs: The Secret Weapon You’re Not Using

Generics aren’t second-rate. They’re the exact same medicine, made by the same companies, under the same FDA rules. The only difference? No marketing, no fancy packaging, no patent protection. That’s why they cost 80-85% less.

Take metformin, the most common diabetes drug. The brand name Glucophage costs $150 for a 30-day supply. The generic? $4. At Walmart’s $4 list, you can get it for less than $1 a pill. Same active ingredient. Same effectiveness. Same side effects.

Even some branded drugs have generic versions you might not know about. For example, the antidepressant Lexapro (escitalopram) was once $200 a month. Now, the generic costs $7. The blood pressure med Lisinopril? $3 for 30 tablets. These aren’t outliers-they’re the norm.

Ask your pharmacist: “Is there a generic version of this?” If they say no, ask again. Sometimes, the brand still has a patent on a specific formulation, but the active ingredient is generic. That’s still cheaper. And if your doctor says it’s not interchangeable, ask for evidence. Most of the time, it’s just habit.

Coupons: Real Savings (If You Know How to Use Them)

Pharmaceutical coupons aren’t scams-they’re rebates you can claim at the pharmacy counter. But they’re not always helpful. Many coupons only work if you have insurance. Others exclude Medicare or Medicaid. Some only cover the portion your insurance doesn’t pay, meaning you still pay the full price if you’re uninsured.

Here’s how to use them right:

- Check the coupon’s fine print. Does it say “not valid with government insurance”? Skip it if you’re on Medicare.

- Use apps like GoodRx or SingleCare. They show cash prices at nearby pharmacies, often lower than your insurance copay.

- Compare the coupon price to the pharmacy’s cash price. Sometimes, the coupon is worse than just paying cash.

- Ask your pharmacist to run the coupon as a cash transaction. Sometimes, it works better than billing insurance.

For example, the asthma inhaler Advair costs $350 with insurance. But a GoodRx coupon brings it down to $140. The same inhaler at Costco’s cash price? $120. No coupon needed. The key is comparing all three: insurance copay, coupon, and cash.

Mark Cuban’s Cost-Plus Drugs is another option. They sell generics at cost plus 15%. No middlemen. No rebates. Just honest pricing. Albuterol? $10. Metformin? $3. Even some brand-name drugs are cheaper here than with coupons.

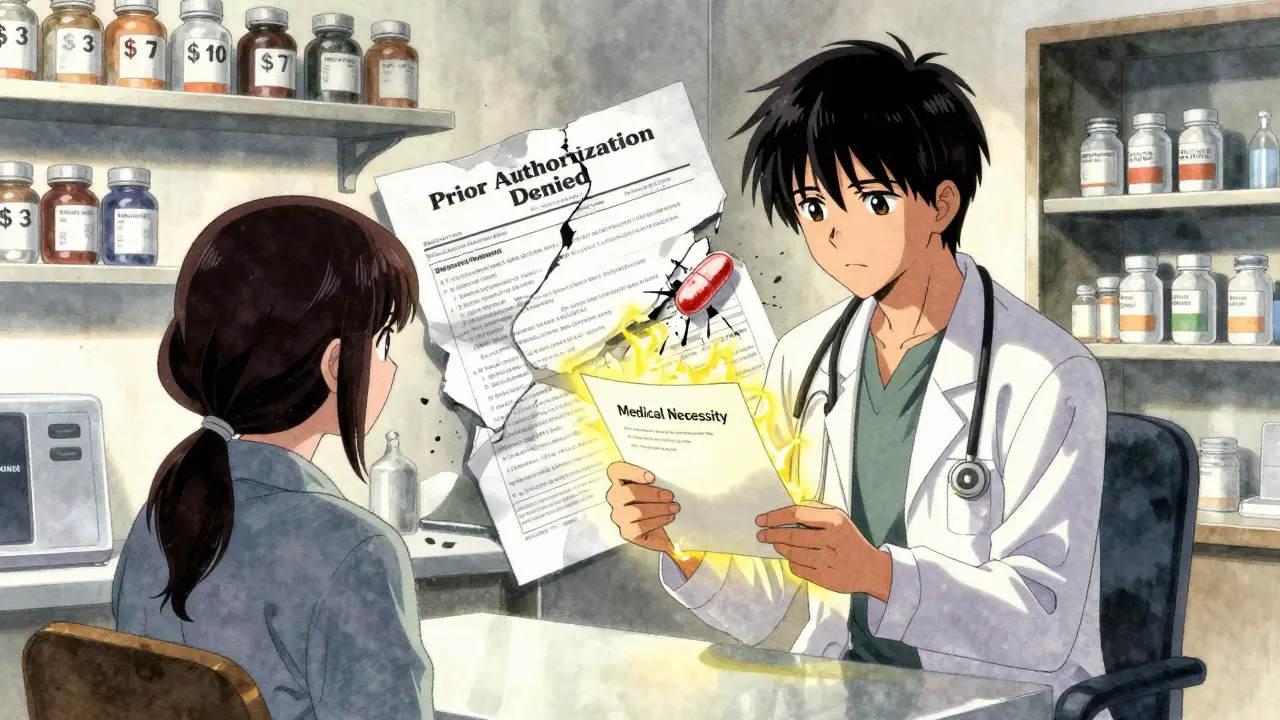

Prior Authorization: The Bureaucratic Hurdle You Can Beat

Prior authorization is when your insurance demands proof before they’ll pay for a drug. It sounds like protection-but it’s often just a delay tactic. Insurers use it to steer you toward cheaper drugs, even if your doctor says you need the expensive one.

Here’s how it works: Your doctor submits paperwork. The insurance company takes 3-7 days to review. If they deny it, you’re stuck. No meds. No refills. You might miss work. Your condition worsens.

But you can fight back:

- Ask your doctor to submit the prior auth request immediately-don’t wait until your refill is due.

- Get a letter of medical necessity. Not just a note. A full letter explaining why the generic won’t work for you.

- Call your insurer. Ask for the name of the reviewer and what they need to approve it. Sometimes, just knowing someone’s watching speeds things up.

- If denied, file an appeal. You have the right. Most approvals happen on appeal.

One patient in Ohio needed the rheumatoid arthritis drug Humira. Her insurer denied it, saying a cheaper biologic would work. Her doctor provided lab results showing she’d tried three others and had zero response. The appeal was approved in 48 hours. She saved $1,200 a month.

Some states now require insurers to approve prior authorizations within 24 hours for urgent cases. Check your state’s rules. If you’re in pain or your condition is worsening, you’re eligible for fast-track approval.

What’s Changing in 2026 (And How It Helps You)

The biggest shift isn’t just coupons or generics-it’s policy. Starting January 2026, Medicare’s new drug pricing rules are rewriting the rules for everyone.

- Price caps: No more spending over $2,000 a year on prescriptions, no matter how many drugs you take.

- Negotiated prices: The first 10 drugs under Medicare negotiation are now priced at 22% less than in 2023. That’s $400+ in annual savings per senior.

- Eliminated coverage gap: The “donut hole” is gone. You won’t hit a wall where you pay 100% out of pocket.

- Medicaid expansion: The GENEROUS Model is forcing drugmakers to align Medicaid prices with what other countries pay. That’s coming to your state soon.

These changes aren’t just for seniors. As Medicare sets lower prices, private insurers often follow. That means your employer plan might drop its prices too.

And it’s not just Medicare. Nine states now have drug affordability boards that set upper payment limits. Minnesota uses Medicare’s negotiated prices as a cap. California limits insulin to $35 per month. These are becoming national trends.

What You Can Do Right Now

You don’t have to wait for policy to fix this. Here’s your action plan:

- Switch to generics. Ask your doctor for every prescription.

- Use GoodRx or SingleCare. Compare cash prices before you pay.

- Ask your pharmacist to check for manufacturer coupons-even if you have insurance.

- If you’re denied a drug through prior authorization, file an appeal. Don’t give up.

- If you’re on Medicare, log into your plan’s website. See which drugs are now priced lower in 2026.

One woman in Texas had three chronic conditions. She was paying $1,800 a month for her meds. After switching to generics, using coupons, and appealing a prior auth denial, she cut her bill to $280. That’s an 85% drop. She didn’t get lucky. She just learned how the system works-and used it.

Medication costs aren’t hopeless. They’re complicated. But they’re not impossible. You have more power than you think. Start with one drug. One coupon. One call. One appeal. That’s how change begins.

Sami Sahil

February 1, 2026 AT 16:43bro i was paying $200 for metformin until i found goodrx. now it's $3 at walgreens. i thought i was getting scammed at first but it was real. my diabetes aint got no budget but my pills do.

franklin hillary

February 3, 2026 AT 02:08the system is rigged but you're not helpless. i used to think coupons were scams until i learned the cash price at cost-plus drugs was lower than my insurance copay. now i buy all my meds like i'm shopping at a farmer's market. no middlemen. no bs. just pills at cost plus 15%. they should make this mandatory. this isn't healthcare. it's a casino with pills.

Ishmael brown

February 4, 2026 AT 04:14lol so now we're supposed to trust the government to fix drug prices? 🤡 next they'll tell us the moon landing was real. insulin was $40 in 2023? sure. and my dog can fly. they're just shifting the pain to taxpayers. you think $25 for lantus is a win? wait till you see the $1000 monthly premium hike to pay for it. this isn't reform. it's redistribution with extra steps.

Jaden Green

February 4, 2026 AT 11:15It's amusing how this article frames pharmaceutical pricing as some sort of personal empowerment puzzle. The reality is that the entire structure is a predatory oligopoly enabled by regulatory capture, patent trolling, and the commodification of biological necessity. To suggest that using GoodRx or appealing prior authorizations constitutes "power" is not just naive-it's an act of ideological gaslighting. The system is not broken; it is functioning exactly as designed. Individual behavioral adjustments do not constitute systemic change, and to imply otherwise is to absolve the architects of this moral catastrophe of their responsibility.

Lu Gao

February 4, 2026 AT 21:25Wait-so you’re saying generics are the same? Then why does my Lexapro generic make me feel like a zombie but the brand doesn’t? 🤔 Also, I checked my insurance app. The "$7" generic? That’s before my deductible. Just saying. 😅

Angel Fitzpatrick

February 5, 2026 AT 12:37They're not lowering prices-they're creating dependency. The IRA? It's a Trojan horse. The same PBMs that set the $120 insulin price are now the ones negotiating the $25. Who do you think owns those "negotiated" contracts? Big Pharma's shell companies. They're using the government to lock in their monopoly under a new name. And the "cost-plus" sites? They're just front companies for the same players. You think you're beating the system? You're just walking into a different room of the same maze.

Melissa Melville

February 5, 2026 AT 15:54So... you're telling me the only way to afford medicine is to become a full-time pharmacy detective? 🙃 I work two jobs and still can't read all these fine prints. Maybe the real problem isn't the coupons-it's that we have to be lawyers just to breathe.

Bryan Coleman

February 6, 2026 AT 09:59goodrx saved my life. i used to skip doses. now i just go to the walgreens down the street and pay $3 for metformin. no insurance needed. no drama. i still dont trust the system but at least i found a loophole. thanks for the reminder.

Naresh L

February 6, 2026 AT 22:51It’s fascinating how individual agency is framed as the solution when the structural violence is so clear. In India, insulin costs $2.50. Why? Because the government refuses to allow patent monopolies on life-saving drugs. We don’t need coupons-we need policy that treats medicine as a human right, not a market commodity. The fact that we’re celebrating $25 insulin as a victory says more about our moral decay than our ingenuity.

June Richards

February 7, 2026 AT 21:00Yeah right. And I'm the Queen of England. Prior auth? More like prior denial. My doctor spent 3 weeks on paperwork for my blood pressure med. Insurance said "no". I cried in the pharmacy. Then I paid cash. $12. You think this is about savings? It's about control. And they win every time.

Nancy Nino

February 8, 2026 AT 20:09While I appreciate the pragmatic advice offered herein, I must respectfully submit that the underlying premise-that individuals can navigate this labyrinthine, profit-driven apparatus through personal diligence-is not merely insufficient, but ethically indefensible. The onus ought not rest upon the sick to become compliance specialists. The moral imperative is clear: medicine must be decoupled from market logic entirely. Until then, we are not solving a problem-we are merely polishing the chains.