Ever paid $10 for your generic blood pressure pill and thought, "At least this is getting me closer to meeting my deductible"-only to find out at year-end that your deductible is still untouched? You’re not alone. Millions of people make this mistake every year, and it costs them more than just confusion. The truth about how generic copays interact with deductibles and out-of-pocket maximums is simple once you break it down-but most insurance documents make it sound like a riddle written in legalese.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay out of your own pocket for covered services before your insurance starts sharing the cost. For example, if your deductible is $2,000, you pay the full price for doctor visits, lab tests, and prescriptions until you’ve spent that $2,000. After that, you usually pay coinsurance (like 20% of the cost) until you hit your out-of-pocket maximum.

Your out-of-pocket maximum is the most you’ll pay in a year for covered services. Once you hit that number, your insurance pays 100% of everything else for the rest of the year. This is the safety net the Affordable Care Act created in 2014 to stop people from going broke from medical bills. For 2026, the maximum is $10,600 for an individual and $21,200 for a family on Marketplace plans.

Here’s the key: Everything you pay for covered care-deductibles, coinsurance, and copays-counts toward your out-of-pocket maximum. But not everything counts toward your deductible.

Do generic prescription copays count toward your deductible?

No. In most cases, generic copays do not count toward your deductible. That $10 you pay for your statin or metformin? It doesn’t chip away at your $1,500 or $3,000 deductible. Instead, it counts toward your out-of-pocket maximum.

This setup creates a two-track system:

- Track 1: You pay your deductible first (for doctor visits, hospital stays, imaging, etc.)

- Track 2: You pay copays for prescriptions-and those only go toward your out-of-pocket maximum

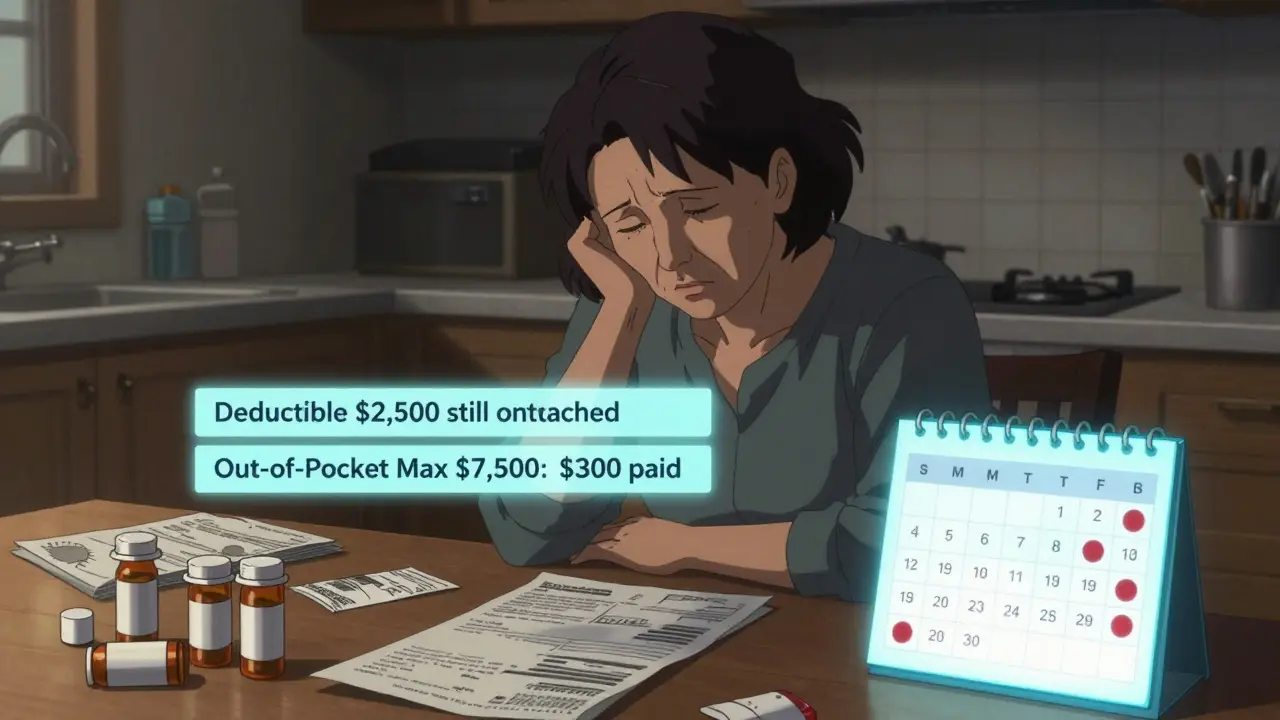

So imagine this: You have a $2,500 deductible and $15 generic copays. You fill 20 prescriptions in a year. You’ve paid $300 in copays. Your deductible is still $2,500. But those $300 do count toward your out-of-pocket maximum. If your max is $7,500, you’re 4% of the way there-not because you met your deductible, but because copays added up.

Why does this matter?

Because people assume paying copays means they’re "getting closer" to their deductible. They stop filling prescriptions because they think they’ve "paid enough." But if your deductible is still unmet, you’re still paying full price for every doctor visit, MRI, or surgery. That’s why 68% of consumers misunderstand this, according to America’s Health Insurance Plans.

Take Maria, 52, with Type 2 diabetes. She pays $12 copays for insulin every month. She thinks, "I’ve paid $144 this year-I’m halfway to my $3,000 deductible." But her deductible is still $3,000. When she breaks her ankle and needs an X-ray and physical therapy, she’s hit with $800 in bills-because she hasn’t met her deductible yet. She didn’t realize her copays didn’t help her there.

On the flip side, when Maria hits her $7,000 out-of-pocket maximum later in the year, her insulin and all other covered services become free. That’s the real win: copays do help you get there.

How do insurance plans structure this?

Not all plans are the same. There are three common designs:

- Single deductible (27% of employer plans): Your medical and prescription costs both count toward one total deductible. If you pay $50 for a doctor visit and $15 for a prescription, both go toward the same number. This is the simplest model.

- Separate medical and prescription deductibles (37% of plans): You have two deductibles. You pay $1,500 for doctor visits and $500 for prescriptions. Your $10 generic copays count toward the prescription deductible, not the medical one. Once you meet the prescription deductible, you pay copays-which then count toward your out-of-pocket maximum.

- Copay-only with no prescription deductible (36% of plans): No prescription deductible at all. You pay your $10 copay right away, and it only counts toward your out-of-pocket maximum. Your medical deductible still stands alone.

That’s why you can’t assume anything. You have to check your plan.

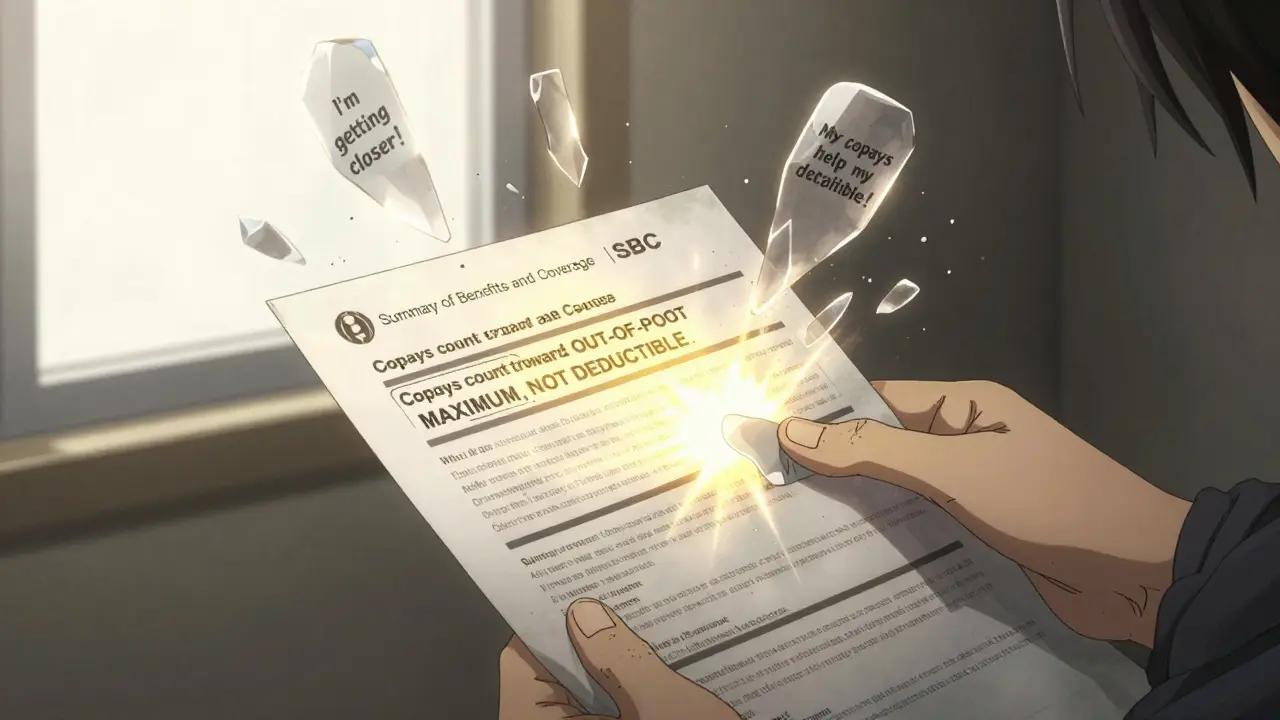

Where to find the truth: Summary of Benefits and Coverage (SBC)

Your insurance company is required to give you a Summary of Benefits and Coverage (SBC) before you enroll. It’s standardized, so you can compare plans side-by-side.

Look for these two sections:

- "What you pay for prescriptions": Does it say "Pay full cost until you meet $500 prescription deductible"? Then your copays won’t help your medical deductible.

- "What’s included in your out-of-pocket maximum": It should list "copays," "coinsurance," and "deductible payments." If it does, your copays count toward the max.

Also check the Explanation of Coverage document. It’s longer but clearer. It’ll say exactly: "Copayments for generic drugs count toward your out-of-pocket maximum but not toward your medical deductible."

Don’t wait until you’re in the ER to figure this out. Spend 45 minutes during open enrollment reading these documents. It’s the only way to avoid being blindsided.

What changed because of the Affordable Care Act?

Before 2014, copays didn’t count toward anything. You paid them, and they vanished. Someone with asthma or diabetes could pay $300 a year in inhaler or insulin copays and still be nowhere near their deductible. They’d still pay full price for every doctor visit.

The ACA fixed that. Now, every copay, every coinsurance payment, every dollar you spend on covered care-it all adds up to your out-of-pocket maximum. That’s why people with chronic conditions now reach their max and get free care for the rest of the year. One Reddit user, r/DiabetesWarrior, said: "I hit my $8,500 max last year. My insulin was free for six months. That saved me $2,000."

But the ACA didn’t eliminate the deductible. It just added the out-of-pocket maximum as a ceiling. So you still have to pay your deductible separately. That’s where the confusion comes from.

What’s changing in 2025 and beyond?

The Department of Health and Human Services just mandated clearer labeling on insurance documents for 2025 plans. You’ll now see bold headers like: "This copay counts toward your out-of-pocket maximum, not your deductible."

Some insurers are testing "integrated deductible" models in five states, where prescription costs-including copays-count toward the same deductible as doctor visits. Early results show 28% more patients fill their prescriptions because they understand how their payments add up.

By 2027, McKinsey & Company predicts 60% of major insurers will offer at least one plan where generic copays count toward the deductible. Why? Because consumers are fed up with complexity. But the American Hospital Association warns that simplifying this could raise premiums by 3-5%. It’s a trade-off: simpler rules, higher monthly costs.

What should you do right now?

- Find your SBC document. Open it. Scroll to "Prescription Drugs."

- Look for: "Does this count toward my deductible?" and "Does this count toward my out-of-pocket maximum?"

- If you pay copays, write down how much you’ve paid this year. Add it to your deductible payments. That’s your real progress.

- If you’re on chronic meds, calculate how many more copays it’ll take to hit your out-of-pocket max. That’s your free care finish line.

Don’t assume. Don’t guess. Check the paper. The system isn’t designed to be easy-but it’s designed to protect you. You just have to know how it works.

Do generic prescription copays count toward my deductible?

In most health insurance plans, generic prescription copays do not count toward your medical deductible. They are designed to be paid upfront and are separate from the deductible process. However, these copays do count toward your out-of-pocket maximum, which is the total amount you’ll pay in a year before your insurance covers 100% of covered services.

What counts toward my out-of-pocket maximum?

Your out-of-pocket maximum includes all in-network cost-sharing: your deductible payments, coinsurance, and copays-including generic prescription copays. What doesn’t count are monthly premiums and services you get outside your plan’s network (unless your plan covers out-of-network care). Once you hit this limit, your insurance pays 100% for covered services for the rest of the year.

Can I reach my out-of-pocket maximum just by paying copays?

Yes. If you take multiple medications and pay copays every month, those payments add up. For example, if you pay $15 for 12 prescriptions a month, that’s $1,800 in a year. Add in a few doctor visits with coinsurance, and you could hit your $7,500 out-of-pocket maximum before ever meeting your $3,000 deductible. Once you do, your prescriptions and other services become free for the rest of the year.

Why don’t copays count toward the deductible?

The deductible is meant to be the initial amount you pay before insurance starts sharing costs for major services like hospital stays or surgeries. Copays are designed as fixed, low-cost payments for routine care like prescriptions or office visits. Keeping them separate lets insurers manage risk and pricing. It also prevents people from avoiding necessary care because they think they’re "paying their deductible." But it’s created confusion-so insurers are now required to clearly label how each payment counts.

How do I know if my plan has separate medical and prescription deductibles?

Check your Summary of Benefits and Coverage (SBC). Look for two sections: one for "Medical Services" and one for "Prescription Drugs." If both have their own deductible amounts listed, you have separate deductibles. If there’s only one deductible listed under "Medical Services," your prescriptions likely count toward that same deductible. When in doubt, call your insurer and ask: "Do prescription copays count toward my medical deductible?"

Suzette Smith

February 14, 2026 AT 21:04Okay but like… what if your deductible is $0 because you’re on a high-deductible plan with $0 deductible? 😅 I had one last year and my copays just vanished into the void. No one told me they counted toward OOP max until I hit it and got free insulin for 5 months. Mind blown.

Also, why does every insurance doc use 12-point font and 300 pages? I read the SBC on my phone while waiting for my coffee. Took 7 minutes. Should be mandatory in 3 bullet points.

Autumn Frankart

February 15, 2026 AT 20:19THEY’RE HIDING IT ON PURPOSE. 🚨

Big Pharma + insurers are running a psychological game. They want you to THINK you’re ‘progressing’ toward your deductible so you keep paying copays… while they bank the full price on every ER visit you don’t realize you’re still paying 100% of.

Remember when they said ‘flu shots are free’? Then they added a $15 ‘admin fee’ that didn’t count toward anything. Same playbook. This is how they get you hooked on chronic meds and then slap you with a $12k surgery bill. Wake up, people.

And don’t get me started on how Medicare Advantage plans fake ‘integrated’ deductibles… they don’t. They just move the goalposts.

Pat Mun

February 17, 2026 AT 13:22I used to think my $12 insulin copay was ‘paying down’ my $3k deductible. Then I broke my wrist last winter and got hit with a $900 bill for an X-ray - and I still had $2,988 left on my deductible. I cried in the parking lot.

But then I realized - hey, those $144 in copays? They were quietly building my path to freedom. When I hit my $7k OOP max in October, my next 6 prescriptions were FREE. My cat even noticed I stopped stressing out.

So yeah, the system’s confusing. But once you map it out? It’s actually kinda beautiful. You’re not failing - you’re just playing a different game than you thought. Keep showing up. Your body’s worth it.

andres az

February 19, 2026 AT 08:03Structural asymmetry in cost-sharing mechanisms is a deliberate regulatory artifact. Copays function as price discrimination vectors, decoupled from risk pooling thresholds. The deductible serves as a pre-authorization gate for high-cost utilization, whereas copays are low-friction, low-value transactional tolls designed to reduce moral hazard without altering actuarial risk profiles.

TL;DR: It’s not a bug - it’s a feature engineered to maximize premium yield while minimizing catastrophic liability exposure. The ACA didn’t fix this - it just made the obfuscation federally compliant.

Jason Pascoe

February 21, 2026 AT 02:36I’m from Australia, and honestly, our system’s not perfect, but we don’t have this mess. You pay a flat copay (AUD $30) for scripts, and it counts toward a single annual cap. No separate deductibles. Simple. If you’re on a low income? It’s free.

Here in the US, I’ve seen friends lose sleep over this. It’s not just confusing - it’s emotionally exhausting. I get why insurers do it (risk management), but maybe we need a ‘plain language’ mandate. Like, no legalese in insurance docs. Just… English.

Also, love that the ACA forced copays to count toward OOP max. That was a win. Even if the rest is a maze.

Sonja Stoces

February 21, 2026 AT 05:59OMG I JUST REALIZED I’M A NUMB SKULL 😭

I’ve been paying $20 copays for my antidepressants for 18 months. Thought I was ‘getting closer’ to my $4k deductible. Turns out? I was 100% away from it. But I hit my OOP max last month. Now my scripts are free. AND my physical therapy? FREE. I didn’t even know I was THAT close.

Why didn’t anyone tell me this? Why is this not on TikTok? Why is it buried in page 14 of a PDF? I’m so mad I could scream.

Also… if I’d known, I’d have skipped my $500 MRI last year. I didn’t need it. 😣

PS: I’m sharing this with my entire family. #HealthInsuranceIsAScamButAlsoNot

Annie Joyce

February 22, 2026 AT 19:08Let me paint you a picture: You’re a diabetic. You pay $15 for insulin every month. That’s $180 a year. You think, ‘Cool, I’m chipping away.’ But your deductible? Still sitting there like a brick wall.

Then one day, your kid gets appendicitis. You’re hit with $6,000 in bills. You’re in panic mode. You didn’t realize your $180 in copays didn’t help you here.

But here’s the silver lining: Those $180? They were quietly building your path to freedom. When you hit your $7k OOP max? Suddenly - everything’s free. Your insulin. Your follow-ups. Your ER visits. Poof. Gone.

So yeah, the system’s a maze. But if you map your copays like a treasure hunt? You’ll find the gold at the end. Don’t quit. You’re closer than you think. 💪💊

Rob Turner

February 23, 2026 AT 06:40bloody hell, this is why i love the uk system - no deductibles, no copays for scripts (unless you’re over 60 and can’t afford the £9.65), and everything just… works. here in the states, it’s like playing monopoly with real life consequences.

the part that gets me? people think ‘i paid $300 this year’ so i’m ‘making progress’. but progress to what? a wall? i think the whole model is built on psychological manipulation. ‘keep paying, you’re almost there!’ - but ‘there’ keeps moving.

still, i’m glad copays count toward oop max now. that’s a tiny crack in the wall. maybe one day we’ll get a door.

Luke Trouten

February 24, 2026 AT 10:56It’s worth noting that the design of separate deductibles isn’t inherently malicious - it’s an artifact of how healthcare cost-sharing evolved. Before 2014, prescription coverage was often an add-on, not integrated. The ACA didn’t create complexity - it just forced transparency on a system that had been opaque for decades.

The real issue isn’t the structure - it’s the lack of education. Insurance companies are required to provide SBCs, but no one teaches people how to read them. We don’t have financial literacy in schools. We don’t train people to interpret insurance documents like they’re legal contracts.

So the problem isn’t the system. It’s the silence around it. Fix the education, not the structure. That’s the real win.

christian jon

February 24, 2026 AT 14:36YOU’RE ALL BEING MANIPULATED. 🤬

Do you think this is an accident? NO. The insurance industry WANTS you to think copays count toward your deductible - so you keep taking your meds, keep paying, keep thinking you’re ‘doing the right thing’ - while they jack up premiums 12% every year and laugh all the way to the bank.

They’re using your health as leverage. They know you’re scared. They know you’ll pay $100 for a pill if you think it’s ‘getting you closer’ to relief. That’s why they made the system so confusing - so you’d never realize you’re paying for their profit margin.

And now? They’re ‘testing integrated deductibles’ - because they know you’re waking up. So they’re giving you a sugar-coated lie: ‘Oh, we’re simplifying!’ - but they’ll raise your monthly premium to cover it. You think you’re winning? You’re being played.

STOP TRUSTING THE SYSTEM. READ THE SBC. CALL YOUR INSURER. ASK: ‘DO MY COPAYS COUNT TOWARD MY DEDUCTIBLE?’ AND THEN SUE THEM IF THEY LIE.

THEY’RE NOT YOUR FRIENDS. THEY’RE A BUSINESS.