When a brand-name drug loses its patent, everything changes. The price doesn’t just drop-it collapses. Within a year, generic versions flood the market, and the company that spent billions developing that drug sees its revenue plummet by 80% to 90%. This isn’t theory. It’s the patent cliff-a financial earthquake every major pharmaceutical company knows is coming.

The Real Cost Difference

Generic drugs aren’t cheaper because they’re lower quality. They’re cheaper because they don’t need to recoup R&D costs. The FDA confirms generics are chemically identical to brand-name drugs, with the same active ingredients, strength, dosage, and safety profile. But while a brand-name drug might cost $300 for a 30-day supply, the generic version often sells for $20 to $60. That’s an 80% to 85% price drop. And it’s not just patients who benefit. In 2024, generic drugs saved the U.S. healthcare system an estimated $330 billion, according to the Schaeffer Center at USC. That’s more than the annual GDP of many small countries.How Generics Are Made Possible

The system that makes this possible started in 1984 with the Hatch-Waxman Act. Before then, generic manufacturers had to run full clinical trials to prove their drugs worked-costing millions and taking years. Hatch-Waxman changed that. It allowed generic companies to file an Abbreviated New Drug Application (ANDA), proving bioequivalence instead of re-proving safety and effectiveness. Suddenly, dozens of companies could enter the market within months of a patent expiring. The result? A race to the bottom on price.Who Wins and Who Loses

Patients win. Taxpayers win. Insurance companies win. But brand manufacturers? They’re left scrambling. Take Humira, the top-selling drug in history. AbbVie earned over $20 billion a year from it before its patent expired in 2023. Within 12 months, generic versions hit the market. Revenue dropped sharply. The company didn’t disappear-but its growth engine stalled. The same pattern repeats with blockbuster drugs like Enbrel, Revlimid, and Keytruda. These aren’t small players. These are multi-billion-dollar businesses built on single products. When generics arrive, investors panic. Stock prices tumble. Analysts revise earnings forecasts. Some companies survive by pivoting-developing new drugs, buying smaller biotechs, or spinning off their generics divisions. Novartis did exactly that in 2022, spinning off Sandoz as a standalone generics company. It was a clear signal: innovation and commoditization don’t mix.

The Hidden Costs of Generics

You’d think lower prices mean lower out-of-pocket costs for patients. But that’s not always true. Pharmacy benefit managers (PBMs)-the middlemen between insurers, pharmacies, and drugmakers-often control pricing in opaque ways. A generic drug might be priced at $15 by the manufacturer, but the PBM negotiates a reimbursement rate of $12 to the pharmacy. If the pharmacy’s cost to buy it is $14, they lose money on every sale. That’s not a typo. Pharmacies are sometimes paid less to dispense a generic than it costs them to stock it. This isn’t hypothetical. Pharmacists on Reddit’s r/pharmacy and r/healthcare regularly post about being forced to fill prescriptions at a loss because PBM reimbursement rates keep changing. The Schaeffer Center estimates patients pay 13% to 20% more than they should for generics because of these hidden markups. The savings aren’t reaching the people who need them.Brand Manufacturers Fight Back

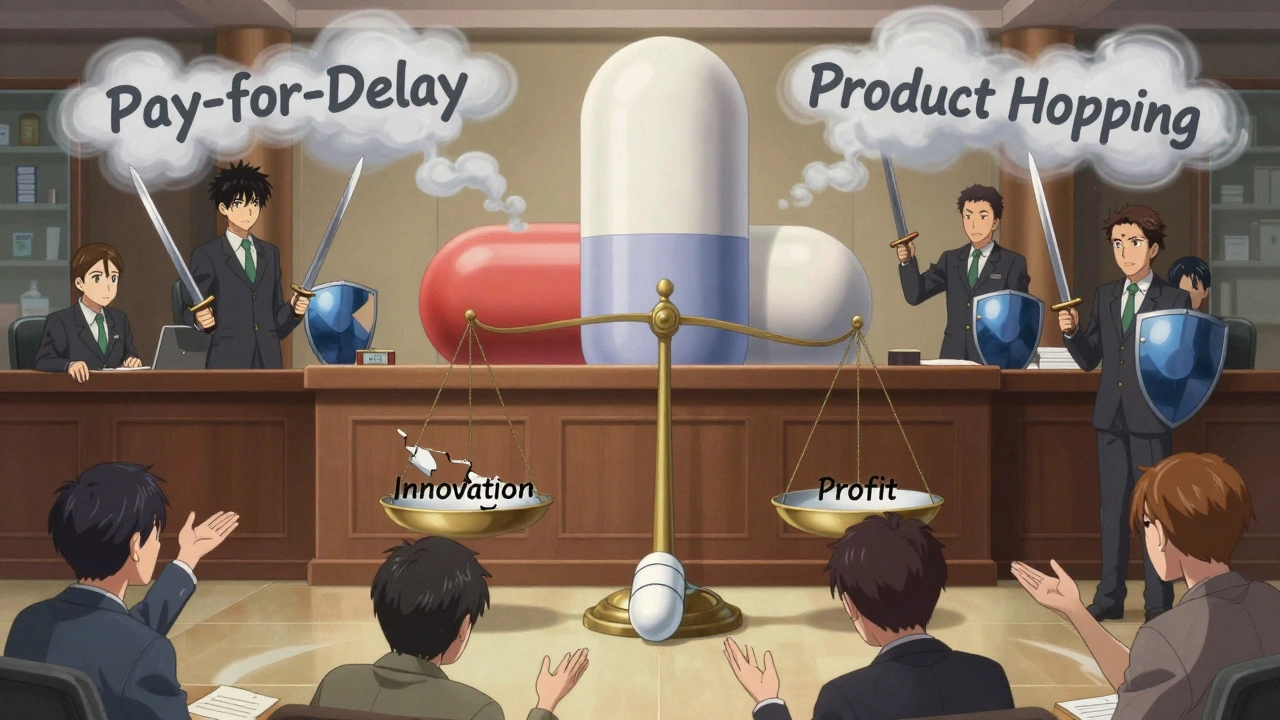

Brand companies don’t just sit back and wait for their revenue to vanish. They’ve built entire strategies around delaying generic entry. One common tactic is “pay for delay”-where a brand manufacturer pays a generic company to postpone launching its version. The Congressional Budget Office estimates these deals cost patients and taxpayers nearly $12 billion a year. In one case, a brand company paid $2 billion to keep a generic version off the market for 13 months. Another trick is “product hopping.” Instead of letting a drug go generic, companies slightly alter the formula-switching from a pill to a tablet, or adding a new delivery system-and get a new patent. This resets the clock. Patients are pushed to the new version, even if the old one worked fine. The CBO estimates ending this practice would save $1.1 billion over 10 years. Then there’s “patent thicketing”-filing dozens of minor patents around a single drug to create legal roadblocks. It’s not about innovation. It’s about delay. The FDA has started pushing back, but it’s an uphill battle.

The Supply Chain Crisis

There’s another side to the generic story: shortages. When prices are razor-thin, manufacturers cut corners. They outsource production to countries with lower labor costs, sometimes sacrificing quality control. In 2024, the FDA reported over 300 drug shortages, many of them generics. Insulin, antibiotics, and heart medications were among the most affected. Why? Because no one wants to make a $0.10 pill when the factory overhead is $50,000 a month. Consolidation hasn’t helped either. Between 2014 and 2016, nearly 100 generic manufacturers merged or were bought out. Fewer players means less competition-and sometimes, higher prices.What’s Next?

By 2028, an estimated $400 billion in brand drug revenue will be at risk from patent expirations. That’s a tidal wave of generic competition coming. Big pharma is responding in three ways:- Investing heavily in biologics and specialty drugs-complex medicines that are harder and more expensive to copy

- Developing authorized generics-where the brand company itself launches a generic version to keep some of the market share

- Shifting focus to international markets where patent protections are weaker and pricing is less regulated

The Bottom Line

Generics are the most effective cost-control tool in modern healthcare. They’ve saved trillions, made medicines accessible, and forced an entire industry to adapt. But the system isn’t fair. Patients still overpay. Pharmacies lose money. Manufacturers fight to protect old revenue streams. And the companies that should benefit most-the ones buying the drugs-are often left out of the pricing conversation. The future won’t be about whether generics are good or bad. They’re here to stay. The real question is: who gets to control the value they create? Until pricing transparency improves and middlemen are held accountable, the savings will keep slipping through the cracks.Why are generic drugs so much cheaper than brand-name drugs?

Generic drugs are cheaper because they don’t need to cover the massive research, development, and marketing costs that brand manufacturers do. Once a patent expires, multiple companies can produce the same drug using the same formula. Competition drives prices down-often to 80-85% less than the brand version. The FDA requires generics to be bioequivalent, meaning they work the same way in the body.

Do generics work as well as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage form, and route of administration as the brand-name drug. They must also prove they are absorbed into the body at the same rate and extent. Thousands of studies and real-world use confirm that generics are just as effective and safe. Millions of people rely on them every day without issue.

Why do some pharmacies lose money on generic prescriptions?

Pharmacy benefit managers (PBMs) set reimbursement rates for generics, and those rates are often lower than what pharmacies pay to buy the drugs. This happens because PBMs negotiate bulk deals with manufacturers but don’t always pass the savings to pharmacies. Some pharmacies end up losing $1-$5 per generic prescription, which adds up fast. This is one reason why independent pharmacies are struggling.

What is a “patent cliff” and why does it matter?

A patent cliff is the sharp drop in revenue a brand drug manufacturer faces when its patent expires and generics enter the market. Revenue can fall by 80-90% within the first year. This forces companies to either develop new drugs, acquire other companies, or spin off their generics business. For investors, it’s a major financial event that can cause stock prices to plummet.

Why are there drug shortages with generics?

When prices are extremely low, manufacturers have little profit margin. Some stop making certain generics because they’re not worth the cost of production or regulatory compliance. Others move production overseas, where quality control can be inconsistent. Consolidation in the industry has also reduced the number of suppliers, making the system more vulnerable to disruptions. The FDA tracks these shortages, and many involve critical drugs like antibiotics and heart medications.

Can brand companies legally delay generic entry?

Yes, but it’s controversial. Some brand companies pay generic manufacturers to delay launching their version-a practice called “pay for delay.” Others file multiple minor patents to extend protection (patent thicketing) or slightly change the drug to get a new patent (product hopping). These tactics are legal under current laws but are being investigated by lawmakers and regulators. Congress has proposed banning pay-for-delay deals, which could save $45 billion over 10 years.

Are there any new trends changing how generics affect the market?

Yes. More brand companies are launching their own “authorized generics”-selling the same drug under a generic label to capture part of the market. Complex generics like inhalers and injectables are taking longer to enter because they’re harder to copy. Meanwhile, legislation is pushing for more transparency in PBM pricing and faster FDA approvals. By 2028, over $400 billion in brand drug sales will face generic competition, forcing the industry to adapt faster than ever.

Paul Dixon

December 11, 2025 AT 12:04Kristi Pope

December 11, 2025 AT 17:40matthew dendle

December 12, 2025 AT 09:05Courtney Blake

December 14, 2025 AT 05:22Taylor Dressler

December 15, 2025 AT 23:20Michelle Edwards

December 17, 2025 AT 01:26Eddie Bennett

December 18, 2025 AT 19:41Aidan Stacey

December 19, 2025 AT 05:19Jean Claude de La Ronde

December 20, 2025 AT 04:07Michaux Hyatt

December 20, 2025 AT 11:51Doris Lee

December 21, 2025 AT 18:23john damon

December 23, 2025 AT 06:33